We all know that life is more complicated than it was in our grandparents’ day. That’s true across the spectrum of life’s issues, but it is especially true in the area of money and finances. Today, there are fewer guaranteed options to rely on and vastly more financial decisions to make. Just a couple of generations ago, investment choices were primarily limited to choosing between stocks and bonds. Today, we are presented with mutual funds, ETFs, master limited partnerships, annuities, and variable universal life insurance, just to name a few.

It’s no wonder that so many of us are left feeling overwhelmed. However, just a few basic principles can bring a little clarity to the confusion.

Truth #1: Wealth Is Not Bad

What do you think of when you hear the word “wealth”? The popular media today often portrays wealth in a negative light. The wealthy are portrayed as not paying their fair share, as being greedy, or as taking advantage of others. However, this interpretation of wealth is not accurate.

Wealth, as properly understood, is the accumulation of resources beyond your current needs. Whatever your financial goals, you will need to spend less than you make (generate a surplus), save that surplus, and invest it so that it will grow to a level which will fund those goals – retirement, college for the kids, your next house, etc. Simply put, you need to build wealth.

If you have a preconceived notion that building wealth is bad, or if you see it as synonymous with being greedy and selfish, you may subconsciously sabotage your financial future. You won’t make the wise decisions needed to accumulate a surplus and invest it, and you won’t accomplish your financial goals.

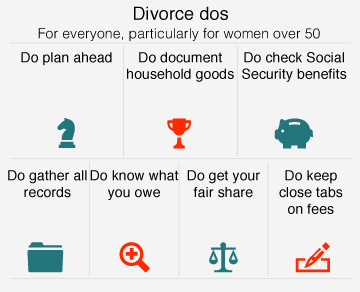

Truth #2: Marriage is Not a Financial Plan

Regardless of whether you are already married or would like to be married someday, marriage is not a financial plan. All marriages will end (either through death or divorce), so it is important to develop a plan for how your needs are going to be met. Even if you’re married now, and remain so for decades to come, you need to take an active role in developing a financial plan for how both of your needs will be met.

Truth #3: Saving a Little is a Really Big Deal

Almost everyone has heard the proverb, “tall oaks from little acorns grow.” Perhaps a better illustration of the power of saving and investing is found in the lesser known saying: “The creation of a thousand forests is in one acorn.”

This is the perfect metaphor because it is a perfect example of how savings create savings. One acorn will give rise to one mighty oak. But to stop there is to miss the magic of the story. The mighty oak will bear additional acorns, which over time, and with the help of the wind, rain, and scurrying animals, will be spread over vast distances. Each additional acorn creates another mighty oak which will create more acorns, and the process grows exponentially.

This is the same sort of magic that occurs with savings and compound interest. You save a little, and over the course of a year, you’ll earn a little interest on that savings. But then in future years you’ll earn interest on the original savings, AND you’ll earn interest on the interest. It compounds! Just as one acorn begets thousands of forests, so too does saving a few dollars beget thousands of dollars for retirement.

Of course, the opposite is also true. We skip the $10 and $50 and $100 contributions to our savings because we don’t see them as the large future amounts they really are. We don’t remember that over 20 years, $10 can become $46; $50 can become $233, and $100 can become $466.

To further illustrate the point, multiply that by twelve months of savings. Saving $50 per month for 20 years can produce a nest-egg of $32,000. Skip just 3 of those contributions each year, and the nest-egg potential is reduced to $24,000. Spending that extra $150 per year (instead of saving it) can cost $8,000. Saving a little is a really big deal.

Truth #4: There Is No Such Thing as Risk-Free

Everyone knows that the stock market is “risky.” Stocks go up, and stocks go down. Some stocks can lose all their value, and you can lose your money if you invest the wrong way in the stock market. However, not investing at all carries its own risk – the risk that the value of your money will not keep up with the pace of inflation (the rise in overall prices). The risk of inflation affects every one of us, and it will always be there.

The long-term average inflation in this country is 3% per year. That means that something which costs $1.00 today, will cost $1.03 in a year, $1.06 in two years. That doesn’t seem like a big change, but in about 24 years the price of that item will have doubled. If your savings are not earning enough to at least keep up with inflation, you will not be able to pay as many expenses (groceries, gas, clothes, electricity, etc.) in the future as you can today. If you are not earning any interest, your money will be worth half as much in 24 years as it is now.

Risks have to be taken…even doing nothing is a risk. The key is to balance the risks on both ends of the spectrum – doing nothing vs. investing everything in the stock market. The good news is that you don’t have to find that balance on your own. There are plenty of objective financial advisors that can walk you through that decision-making process to find the level of risk that is appropriate for you and your financial goals.

Truth #5: You Have To Start Now – Not Sometime Next Month, Year, or “Later.”

We all put off doing what we don’t want to do, what we don’t understand, or what intimidates us. Dealing with money and finances can hit all three of those procrastination triggers.

Understanding the resources you have and the debts that you owe, building a budget, and developing a financial plan are all learned skills. You don’t have to be “good with money” to take control of your financial future. It requires an investment of your time, and will likely require outside advice, but you can be successful – in fact, very successful!

The time to begin developing financial security is today. Whether you start small or start big, the important thing is to start. If you don’t know where to start, call an objective financial planner – not one of the ones who will sell you the latest, greatest annuity, mutual fund or insurance product, but one of the ones who offer advice free from any conflicts of interest. Most of these objective advisors will give you an hour or so, and a few pointers to get started, for free.

Carpe Diem

There you have it: 5 money truths that will help you feel less overwhelmed and intimidated by the financial decisions that all of us face. Though none of these truths are new, they are unknown or ignored by many. Learning to live by them will allow you to positively impact your financial security. Ignoring them can lead to insecurity at the least, and calamity at the extreme. Now is the time to take control and chart your own future. Now is the time to seize the day.