Reprinted with permission from Fidelity.com’s viewpoints 3/13/14

For people over 50, the divorce rate in the United States is on the rise. Just one in 10 people who divorced in 1990 was age 50 or older; twenty years later it was one in four, according to Dr. Susan Brown, professor of sociology at Bowling Green State University and co-author of “The Gray Divorce Revolution.”1 “If late-life divorce were a disease,” says Jay Lebow, a psychologist at the Family Institute at Northwestern University, “it would be an epidemic.”

Reasons for the surge in splits vary. Increasing longevity offers more risk that couples might grow apart; the kids have grown up and moved out, taking with them reasons for staying together; more women are working, with some of them out-earning their spouses; and, there’s less stigma to calling it quits.

Whatever the reason, later-life divorce hits women especially hard. After a divorce, household income drops by about 25% for men—and more than 40% for women, according to U.S. government statistics.2 “Gray divorce can be economically devastating, especially for women who have been out of the labor force,” says Dr. Brown.

At the same time, retirement is more expensive when you’re solo rather than half of a twosome. On a per-person basis, the cost of living for singles is 40% to 50% higher than for couples, according to the American Academy of Actuaries.3 And another consequence of a mid- to later-life split is that there’s less time to recover financially, recoup losses, retire debt, and ride out market ups and downs. Meanwhile, women’s life expectancy is climbing into the 80s, meaning that they may be living longer with less.

So how can women over 50 protect their financial future when they go solo? Here are a few dos and don’ts to consider:

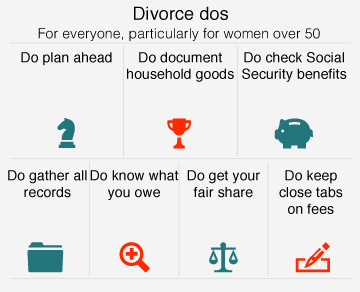

Seven divorce dos:

- Plan ahead.Careful preparation before your divorce may pay off. For instance, having a financial planner or accountant work with your divorce lawyer or mediator can help you make the right decisions about a divorce settlement that includes a more comfortable retirement.

- Gather all records.“The three most important words during divorce are document, document, document,” says Ginita Wall, a financial planner and co-founder of WIFE.org (Women’s Institute for Financial Education). Make a clear copy of all tax returns, loan applications, wills, trusts, financial statements, banking information, brokerage statements, loan documents, credit card statements, deeds to real property, car registrations, insurance inventories, and insurance policies. Copy records that can trace and verify your separate property, such as an inheritance or family gifts.

- Know what you owe.Hidden debt is a common nasty surprise among divorcing couples. In the nine states with community property laws—Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin—you’ll be held responsible for half your spouse’s debt, even if the debt isn’t in your name. You may also run into trouble in a non–community property state if you and your spouse hold credit cards or loans jointly. Get a full credit report to make sure there are no surprises on it. Annualcreditreport.com provides free credit reports every 12 months from each of the three credit bureaus.

- Document your household goods.Take photos of valuables around the house—jewelry, art, Oriental carpets, the sterling silver tea set. It’s not unheard for divorcing spouses to hide assets from one another.

- Get your fair share. Half of everything is yours—if you acquired it during your marriage—whether you want it or not. Even if you’ve always abhorred that LeRoy Neiman painting your husband insisted on buying, it can be used to trade for something you do want. If you helped put your husband through graduate school, law school, or medical school, you may be entitled to some reimbursement for the cost of his tuition.

- Keep close tabs on legal and adviser fees.What you pay your divorce advisers will come out of your settlement, so make sure you keep track of what they are spending on your behalf. Remember that your lawyer is a paid professional who is billing you at an hourly rate. Be mindful of the time your lawyer spends with and for you.

- Check Social Security benefits.Although many age-50-plus women have had successful careers, their ex’s earnings may provide a larger Social Security benefit. You are eligible to collect those benefits if you meet the following conditions:

- You must be age 62 or older.

- You must have been married for 10 years or longer.

- You must not be currently married.

- Your own earnings must not entitle you to receive a higher benefit.

And there’s more good news for divorcees. According to the Women’s Institute for a Secure Retirement (WISER), you can receive your share of your ex-spouse’s Social Security benefits without filing any special papers at the time of the divorce, and—as long as you remain unmarried—you will qualify for those benefits even if your ex marries again.4

Four divorce don’ts

1. Don’t necessarily hold onto the house. Your house may have sentimental value, but keeping it doesn’t always make financial sense, especially if it’s a stretch to pay for the upkeep and property taxes. Compared with a well-diversified retirement savings account, a home is more likely to have ongoing and unexpected expenses, and its future value isn’t assured.

2. Don’t ignore tax consequences. Should you take monthly alimony or a lump sum? Should you take the brokerage account or the retirement plan? Should you keep the house or sell it now? Who should pay the mortgage until it sells? You may need to consult an accountant or tax adviser to determine what makes sense for your situation, and if there’s a chance that your past joint tax returns omitted income or overstated deductions, you may want to consider an indemnification clause to protect yourself in case of an audit.

2. Don’t ignore tax consequences. Should you take monthly alimony or a lump sum? Should you take the brokerage account or the retirement plan? Should you keep the house or sell it now? Who should pay the mortgage until it sells? You may need to consult an accountant or tax adviser to determine what makes sense for your situation, and if there’s a chance that your past joint tax returns omitted income or overstated deductions, you may want to consider an indemnification clause to protect yourself in case of an audit.

3. Don’t forget about health insurance. If you’ve been covered by your spouse’s policy, you may face a gap in coverage after your divorce and before Medicare kicks in at age 65. If you don’t have coverage of your own at work, you can continue your spouse’s existing coverage through COBRA for up to 36 months, but your cost is likely to be substantially more than it was before the divorce. It may also be more expensive than the health care coverage you can get from your state’s health insurance exchange under the new Affordable Care Act, so it’s best to check. Couples who can’t afford new, separate health insurance policies may want to consider a legal separation instead; that way, you can keep your ex’s health insurance but separate the other assets.

4. Don’t immediately roll over your ex’s retirement account into an IRA. If your divorce settlement allocates assets under a qualified domestic relations order (QDRO), you can make a one-time withdrawal from your ex’s 401(k) or 403(b) without paying the normal 10% tax, even if you’re under age 59½. If you think you’ll need money for unavoidable divorce expenses, you may want to make the withdrawal rather than doing a rollover. Otherwise, if you roll the money into an IRA and then need to tap it for divorce costs, you’ll be subject to the standard 10% early withdrawal penalty.